Stilt Will assist while Covered by DACA or in the U.S. with the a charge

Moving to brand new U.S. should be a difficult activity for many people. Immigrants tend to deal with challenges having building profit, providing fund and you may starting an alternative lifestyle inside the a different country. Starting the fresh new social networking sites and you may looking for monetary versatility needs time to work and you can work.

One of the greatest demands gets a bank account otherwise approved having finance, specifically without a working credit rating, it doesn’t have to be. Creditors are not attending approve a software instead of a credit score, despite an immigrant visa.

Other challenge is getting a personal Defense Count (SSN), in fact it is difficult and you will full of judge and you can qualification points, papers issues or other hurdles.

Thankfully, a few higher solutions are around for let U.S. immigrants manage their funds, just take loans and create credit. Fintech companies particularly Stilt will assist while included in Deferred Step for Childhood Arrivals (DACA) or perhaps in the new U.S. into the a charge.

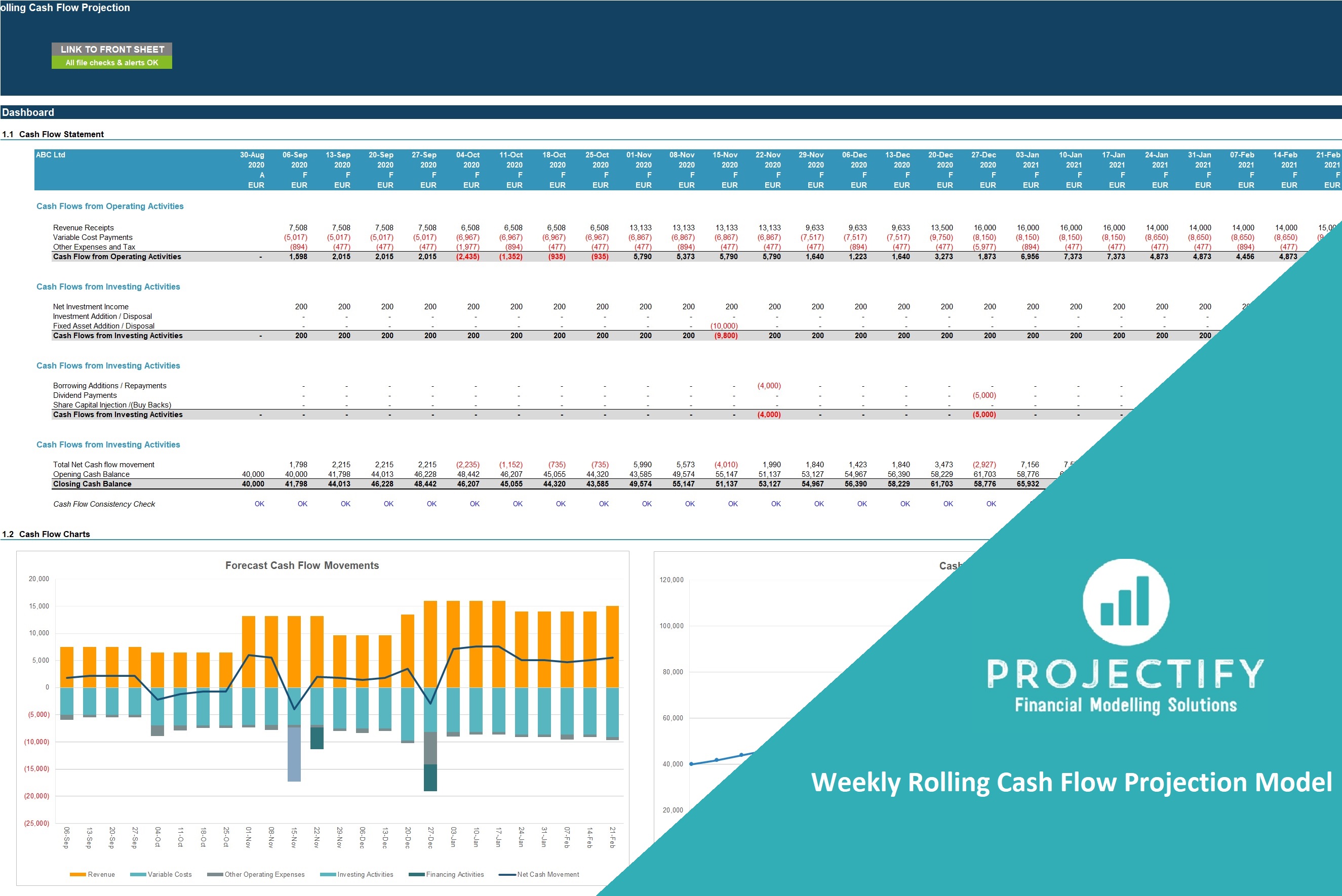

Unlock an account, Get that loan and create Borrowing from the bank That have Stilt

Stilt is actually an on-line platform that provides immigrants having examining profile, funds, remittances and credit creator facts. The organization deals with candidates typically seen as highest risks, such as for example visa people, DACA people, refugees and you may asylum candidates.

The company is depending of the Rohit Mittal and you may Priyank Singh, one or two around the globe youngsters which didn’t get approved to possess money regarding You.S. during the time. According to a job interview having Forbes, they both looked after the challenges off opening economic qualities as the immigrants and you will wanted to do a pals so you can suffice someone else without Societal Protection wide variety or borrowing from the bank records.

Since doing the trip and beginning the business more four in years past, Stilt has aided tens of thousands of immigrants having financial products. The organization enjoys protected them many in charge and you may attract. A study out-of TechCrunch listed one Stilt merely finalized a $a hundred million bullet out of resource at the beginning of 2021.

Do not let a credit rating Stop Your

Unlike normal lenders, Stilt doesn’t count exclusively on your own credit rating so you’re able to agree a loan application, and you can profiles don’t require an excellent co-signer. This is why, customers with reduced credit otherwise the fresh new immigrants still have financial possibilities. Stilt talks about additional factors such as for no income verification personal loans instance newest work, studies, series and people earlier bankruptcies whenever examining the application.

Financial Account Built for Immigrants

Options and you will membership having Stilt typically takes in the five full minutes. Membership citizens will get an online debit cards and stay able to spend, save your self and you can would their cash. It is a powerful way to get yourself started building your money and dealing into the the future.

More importantly, Stilt cannot fees any overdraft charge, therefore has no criteria to have lowest dumps. The firm brings digital and you will physical debit notes, person-to-people transmits, a lot of confidentiality and you can security measures, and you can a simple-to-fool around with software to own participants.

If you’re looking to acquire a loan or create borrowing from the bank with Stilt, here are a few of the eligibility conditions to get going:

Very Charge Brands Acknowledged

Stilt doesn’t require a social Cover Number otherwise eco-friendly credit in order to apply. Yet not, you must be personally found in the brand new U.S. and also have a bank account on your own term for the a good You.S. address. Without having a bank checking account, you might unlock a free account which have Stilt basic and apply for a financial loan later on.

- CPT

- Opt

- H-1B

- O-step one

- TN

- J-1

- L-step 1

Get a loan Out of Stilt

- Yours advice

- How much cash you desire during the U.S. bucks

By way of Stilt, financing wide variety are priced between $1,one hundred thousand in order to $35,000, that have restrict mortgage regards to doing 36 months. There are no prepayment penalties, so you can pay back the loan very early without the additional charges otherwise interest.

Competitive Interest levels

When you use Stilt, unsecured loan interest rates is below typical creditors, specifically for immigrants that have minimal credit rating. In that way, immigrants could possibly get that loan and commence strengthening credit and you will a upcoming.

Unsecured loan interest levels ranges off six per cent to thirty-six percent, according to . By the beginning a free account that have Stilt, immigrants could work with the improving its borrowing from the bank; this could eventually end up in down rates of interest having loans. So, discover a merchant account while having been now.

Working with Stilt would-be among building blocks your must ensure it is, build your credit and you will chase the “American dream” when you go on to the fresh U.S..

Stilt was created to make money troubles-free getting immigrants, visa owners, DACA people, refugees and you can asylum people. Find out more right here and complete an on-line loan application on the morale of your own chair .

The latest items in this post is to have informative objectives simply and you will cannot constitute economic otherwise financing advice. It’s important to manage the browse and consider trying to information away from another financial top-notch before you make any financial support conclusion.