Essentially, you ought not risk remove people the latest financial El Paso installment loans no credit check obligation when you are undergoing closing a mortgage. Therefore, whenever Might you Rating an unsecured loan Shortly after To acquire a property?

As well as, once you’ve finalized to the a loan, you probably need certainly to waiting 3 to 6 months before taking aside a personal loan.

Signature loans can be handy to own property owners, and there is no official signal you can not make an application for one when you find yourself finding a property.

- Your credit score usually takes a hit and you will apply at your loan cost

- Your debt-to-income proportion get increase and you can apply to your mortgage qualification

- When you are currently handling a lending company, they’re notified on mortgage activity

- You may even impact the mortgage eligibility regardless if you been cleaned to close off

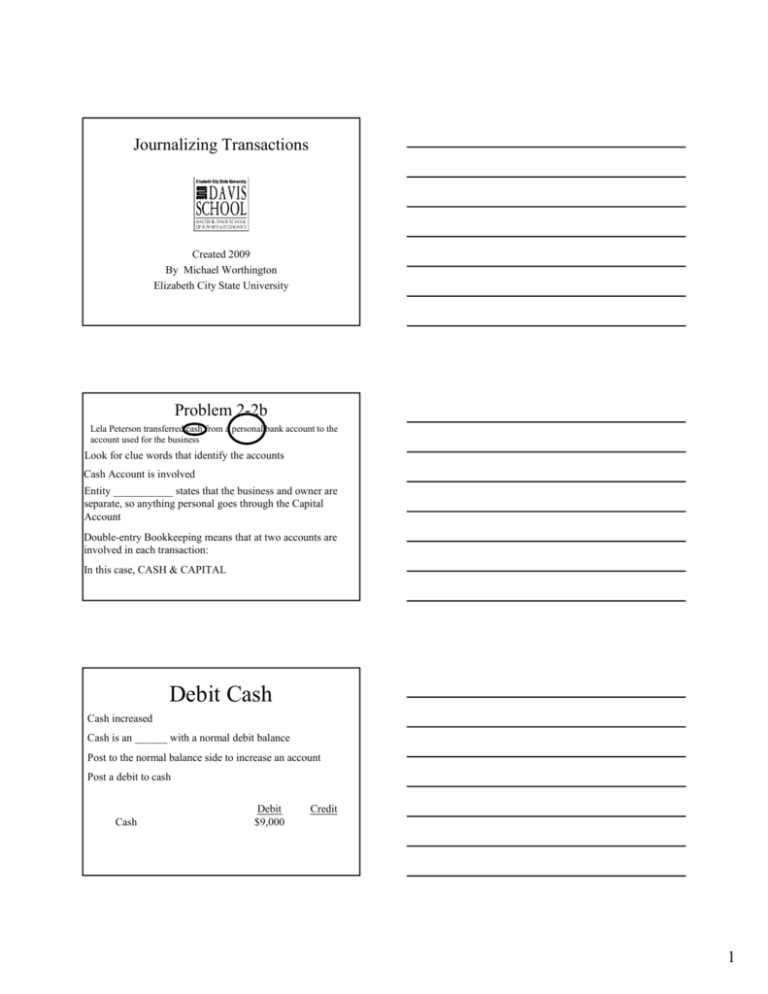

When you find yourself nevertheless unsure out-of whether you really need to sign up for a great consumer loan when purchasing property, here is a keen infographic which can help you see:

When you get a personal loan When buying a property? Do’s and you will Don’ts

- Make an effort to take out an unsecured loan to cover the new down-payment.

- Propose to acquire to pay for closing costs, inspections, swinging can cost you, etcetera. with a personal bank loan.

- Take out financing at all if you plan to utilize to possess a home loan soon, generally speaking.

- Attempt to hide unsecured loan interest off lenders.

- Have fun with a consumer loan to own expenses like furniture, repairs, renovations, and you will low-financial costs well after you have currently settled on the new home.

Expenditures associated straight to the fresh new revenue-such as for example appraisals, inspections, and you may down costs-are typically taken care of that have cash otherwise regarding currency lent physically throughout the lending company.

Remember that this relates to more than simply personal loans. Actually credit of friends can occasionally have unforeseen effects. Since the tend to, financial specialist feedback debt craft observe the length of time you have had your bank account. People sudden higher develops may have to end up being told the brand new potential mortgagor, which may hurt the possibility in order to qualify for a home loan.

Help! I bought a property and today I’m Domestic Worst

In the event the mortgage repayments was trying out alot more than the advised twenty five% of one’s get-house spend, it is possible to getting financially restricted, aka domestic poor.

It is a tricky state to cope with. Here are a few info if you are facing a property-relevant overall economy:

While in Doubt, Pose a question to your Mortgage Administrator

Personal loans will come for the available to people trying advancements or repairs. However they should be problematic to utilize close to domestic-buying time.

Nevertheless, you can query the newest agent you’re working with in the event the bringing aside an unsecured loan can be helpful. Per mortgagor varies and more than want to make it easier to features a profitable homebuying experience, so it’s generally beneficial to trust its direction.

All the information within this post is actually for standard educational intentions only. Republic Finance cannot make any warranties or representations of any type, show or implied, with regards to the advice considering contained in this blog post, including the reliability, completeness, physical fitness, flexibility, access, adequacy, otherwise reliability of one’s recommendations in this blog post. All the details contains herein is not meant to be and does perhaps not create financial, court, tax or other advice. Republic Money does not have any responsibility for mistakes, omissions, or inaccuracies in the suggestions or people accountability as a result of any dependency put on instance information by you or anyone who get be advised of your information in this article. Any dependency you devote to your information within this article is strictly at the own exposure. Republic Financing can get site businesses in this blog post. A 3rd-cluster reference doesn’t constitute sponsorship, association, union, or endorsement of these third party. People third-party trademarks referenced are definitely the assets of the particular owners. Your have fun with and access to this website, website, and people Republic Fund webpages otherwise mobile software program is subject to our Terms of service, available right here.