Article Mention: The content for the post is dependant on the newest author’s views and you will guidance by yourself. May possibly not have been reviewed, accredited if not endorsed of the some of our very own community people.

Borrowing up against the equity you have built in your home is a major monetary choice that includes several threats, particularly when you’re considering a home guarantee loan having debt consolidation reduction. At all, for folks who default with the money, you could potentially beat your home in order to foreclosure.

Property guarantee mortgage is a kind of 2nd financial you to definitely allows you to borrow against the newest readily available security of your house. If you use a home security mortgage to pay off obligations, you’re cashing on your security and you can buying and selling numerous monthly payments – that have varying interest rates – for just one repaired focus-rates percentage.

- Pros of employing a property collateral loan getting debt consolidating

- Drawbacks of utilizing a house guarantee financing to possess debt consolidation

- 5 possibilities so you can a home guarantee loan to possess debt consolidation

Positives of utilizing a house collateral loan to own debt consolidation

You have got an interest rate that’s less than almost every other financing models. A house guarantee loan was a secured mortgage, and these particular funds generally have down interest levels than signature loans. Eg, interest rates into the personal loans, that are unsecured, can vary of 5% to help you thirty-six%, based on ValuePenguin data. By contrast, house security mortgage costs ranges from about 2.5% to ten%.

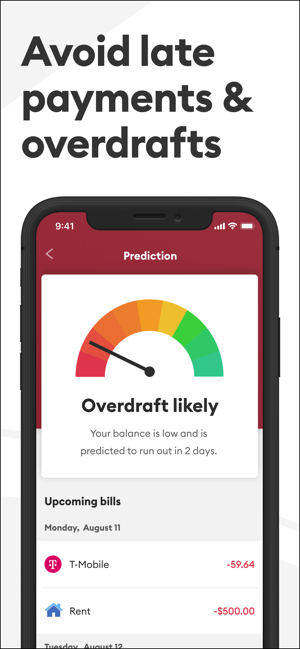

You could potentially combine numerous debt obligations on one payment per month. A major brighten of employing a property guarantee loan having debt combination ‘s the simplicity it contributes to your debt cost approach. As opposed to trying track numerous money to possess car, individual or figuratively speaking, credit cards or any other sort of debts, that have a home guarantee mortgage, you could potentially move all expenses into the an individual direct express emergency cash feature percentage. This makes it simpler to control your monthly installments.

You will get less costly payments and you will repay your debt shorter. As the domestic guarantee financing generally have lower rates of interest than just a number of other financial products, you could potentially save plenty into the appeal costs immediately after using house guarantee to repay personal debt. While doing so, more substantial percentage of your percentage is certainly going towards the cutting your dominant equilibrium every month, on account of a lower interest. You could also get out of obligations eventually of the opting for a smaller fees label.

Downsides of using a property equity financing to own debt consolidation

Your exposure shedding your property to help you foreclosures. Your home is made use of since collateral into the a house collateral loan, and thus if you fail to build costs, your financial can be repossess your residence from the property foreclosure process. You’ll also get a hit towards borrowing in the process.

You will never have the ability to subtract interest paid back into the family guarantee mortgage. If you are using family security loan finance to fund one thing besides home improvements, it is possible to beat the capability to deduct the mortgage focus you pay with the financing from the federal tax bill.

Possible pay multiple charge, plus settlement costs. They will cost you currency to borrow money, which pertains to having fun with a house security financing to settle personal debt. Taking out fully a home security loan involves getting a home assessment to ensure their residence’s really worth, hence will cost you $300 to $eight hundred. You will also have other household equity loan closing costs, and mortgage origination and you may name fees.

You will likely sense closing waits. It often takes 2 to 4 months to close property guarantee mortgage, but in a low interest rate-rate environment in which you will find an influx out of lending pastime and you will family appraisers is actually overwhelmed, there is certainly a put off in your closing big date.

You happen to be boosting your financial obligation stream. You’re borrowing from the bank a lot more obligations to settle almost every other loans, hence grows your debt-to-income (DTI) proportion. Your DTI proportion indicates the fresh percentage of your own disgusting month-to-month income being used to settle loans, and assists determine their eligibility for loans, credit cards or any other forms of borrowing.

5 selection in order to a property security mortgage for debt consolidation reduction

If you are not pretty sure having fun with a house security financing to have obligations integration is good for your earnings, investigate pursuing the selection.

- HELOC

- Equilibrium transfer credit card

- Personal bank loan

- Obligations management bundle

- Case of bankruptcy

HELOC

Property guarantee credit line (HELOC) is another type of 2nd financial. Unlike a lump sum, an effective HELOC try an effective revolving credit line that actually works much like a charge card. You are able to an excellent HELOC to settle obligations by withdrawing from the credit line, paying down it and you will withdrawing of it again as required – inside the mark period, which could last 10 years. At exactly the same time, you merely create payments centered on everything you withdraw, as well as attention.

- It’s a beneficial rotating credit line as opposed to that loan

Harmony import mastercard

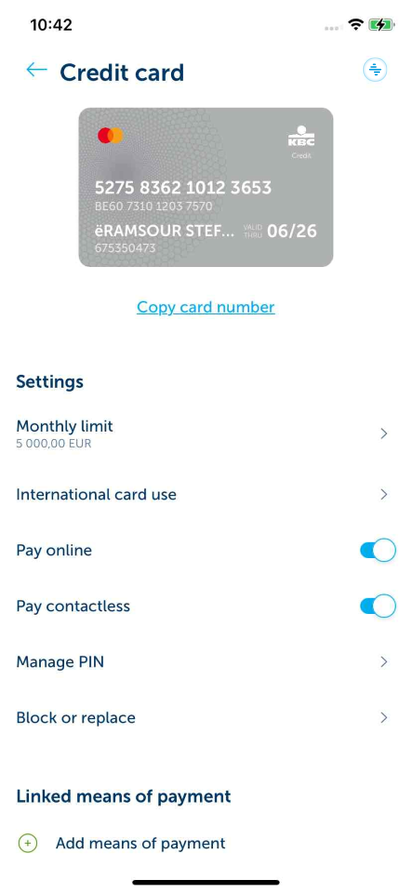

When you yourself have solid borrowing, you’re eligible to transfer what you owe from a leading-attention bank card to at least one which have an introductory 0% apr (APR) to own a-flat go out. Certain handmade cards can help you import a balance with no fees and then make payments rather than notice for a great seasons or offered, that get you time for you lower the bill minus even more costs.

Personal loan

Unsecured loans are usually unsecured, and therefore they don’t wanted guarantee including car loans or house equity money carry out. Moreover it mode rates is actually highest so you can account fully for this new extra financing chance in it. Borrowers that have good credit results can get be eligible for a personal loan who’s a lower interest rate than simply their newest expenses, including handmade cards, nevertheless the rate may be more than the rate to have a home equity financing.

Debt government plan

In many cases, going right on through a good nonprofit borrowing guidance institution is a feasible option for customers who want to manage its loans rather than scraping their house equity. Credit advisors establish you for the a financial obligation management package (DMP) having a single payment per month, nonetheless also can try settling with financial institutions to reduce focus cost.

Bankruptcy

In case the financial obligation is simply too overwhelming to manage, you may have to think declaring bankruptcy. Big cons from the choice through the large will set you back involved, while the destroying outcomes it has on your credit score. Bankruptcy proceeding can be stay on your credit report having seven in order to ten decades, depending on which kind your file. Because of the outcomes, bankruptcy proceeding is going to be a highly last option.