Truist doesn’t express facts from the borrower certification, aside from saying they weighs half a dozen general circumstances with regards to candidates: money, money balances, credit history, how your mortgage payment compares with your most recent casing will cost you, whether you may have sufficient currency to possess an advance payment and closing will set you back, and property appraisal.

Even before obtaining preapproval that have Truist, you need to use their online calculator to find out simply how much you really can afford to fund a property and you may a monthly payment. When you yourself have questions relating to whether or not you meet up with the lowest requirements to have a home loan, conversing with a beneficial Truist home loan top-notch over the telephone is assist. A community elite group – obtainable in some says – may also be helpful you determine if you be eligible for any off commission provides otherwise guidance.

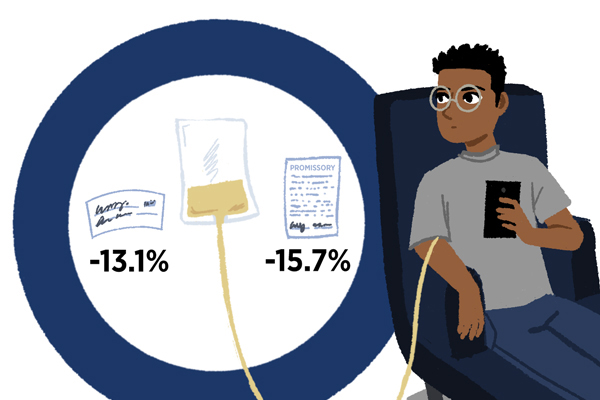

Costs and you will charges

Will cost you and costs into the good Truist Home loan financial will vary depending into the situations such as your place therefore the types of loan. g., points, origination costs), third-people seller charges (elizabeth.g., appraisal fee, term insurance rates), regulators fees (age.g., tape charge, transfer of taxes) and prepaid service escrow dumps (e.g., taxation, insurance).

After you complete your application that have Truist, it will deliver a loan Guess contained in this three working days. This form boasts the expense and you will fees which might be part of your loan. You’ll then see closed quantity at the least 3 days ahead of closure in the Closure Revelation mode.

Truist Home loan has the benefit of an on-line process getting preapproved and you can applying. Financing officers arrive by mobile plus member of particular components to guide you and respond to questions. When you apply, you could track the fresh progress of your financing on the internet.

Truist Financial are a valid financial you to definitely starts thousands of lenders annually. Truist formed in the later 2019 following merger out of BB&T Corporation and you may SunTrust Banking companies.

Truist Mortgage loans are available in all the says but Alaska, Washington and you may Hawaii. HELOCs appear in 18 says and you can Washington, loan places Quinebaug D.C.

Truist Home loan Evaluations

Keep minutes towards the cellular phone over a couple of hours to dicuss to help you a beneficial support service user whenever you are looking to register to expend the new mortgage. Customer care broker quickly enacted brand new buck and provided for me personally other extension having another requested fifty time keep time for the brand new 2nd representative. Do not sell to this mortgage lender. Its mobile apps and you can alternative registration options dont works.

I performed a great Virtual assistant refinance via Suntrust within the 2021 because enough banking companies don’t have Va re-finance financing. They grabbed six months to-do while i is informed sixty days up front. Never ever would a Va re-finance through Suntrust if you prefer an excellent elite group feel. I ended up expenses plenty a great deal more as they got half a year rather than dos such as for instance they guaranteed.

Absolutely Horrendous/non-existent customer support. 6+ weeks regarding routine calls attempting to rating remedies for essential issues away from my personal home loan, my forbearance position, an such like. Dead-prevent mobile phone solutions you to definitely condition “that is not a functional matter” and automatically avoid the phone call, totally low-existent Home Maintenance “Specialist” that does not go back calls otherwise address letters – may as well getting a ghost. Of the many something in which to include dreadful, atrocious customer service. home financing really should not be one of them. I could prevent SunTrust/Truist throughout living.

Of all the financial institutions which i has actually actually looked after, which lender contains the Worst support service previously. Its wait moments was 1-couple of hours much time, they run-on EST, which for somebody inside California was unnecessary, as well as their customer care agencies hang up toward people. It ordered more than 17,000 the mortgage loans and then delivered threatening letters and you will letters stating that we had been unpaid inside our levels and you can harmful in order to give us so you can series inside pass regarding state and federal rules! They just weren’t even sorry about that and only mentioned that the page went out “within the error”!