Truist auto loans immediately

Truist even offers auto loan choices for the, made use of and amusement car. If you find yourself Truist primarily approves auto loans directly or higher the new mobile phone, borrowers may apply on the internet using LightStream, Truist’s on the internet division. Some tips about what we offer if you get good Truist automobile loan:

- Competitive APRs: Rates of interest may start as little as six.24% to own individuals having being qualified credit users.

- Versatile mortgage terms: You could acquire quantity as little as $3,five hundred (may vary in a few says) that have terms and conditions extending around 84 weeks.

- Rate secure make certain: As soon as your financing is approved, your interest is closed for the next 30 days, that provides you time for you to research rates or re-finance.

- Adversity assistance: Truist now offers short-term percentage rescue alternatives, eg shorter interest rates or stretched payment terms and conditions, in order to individuals against monetary challenges.

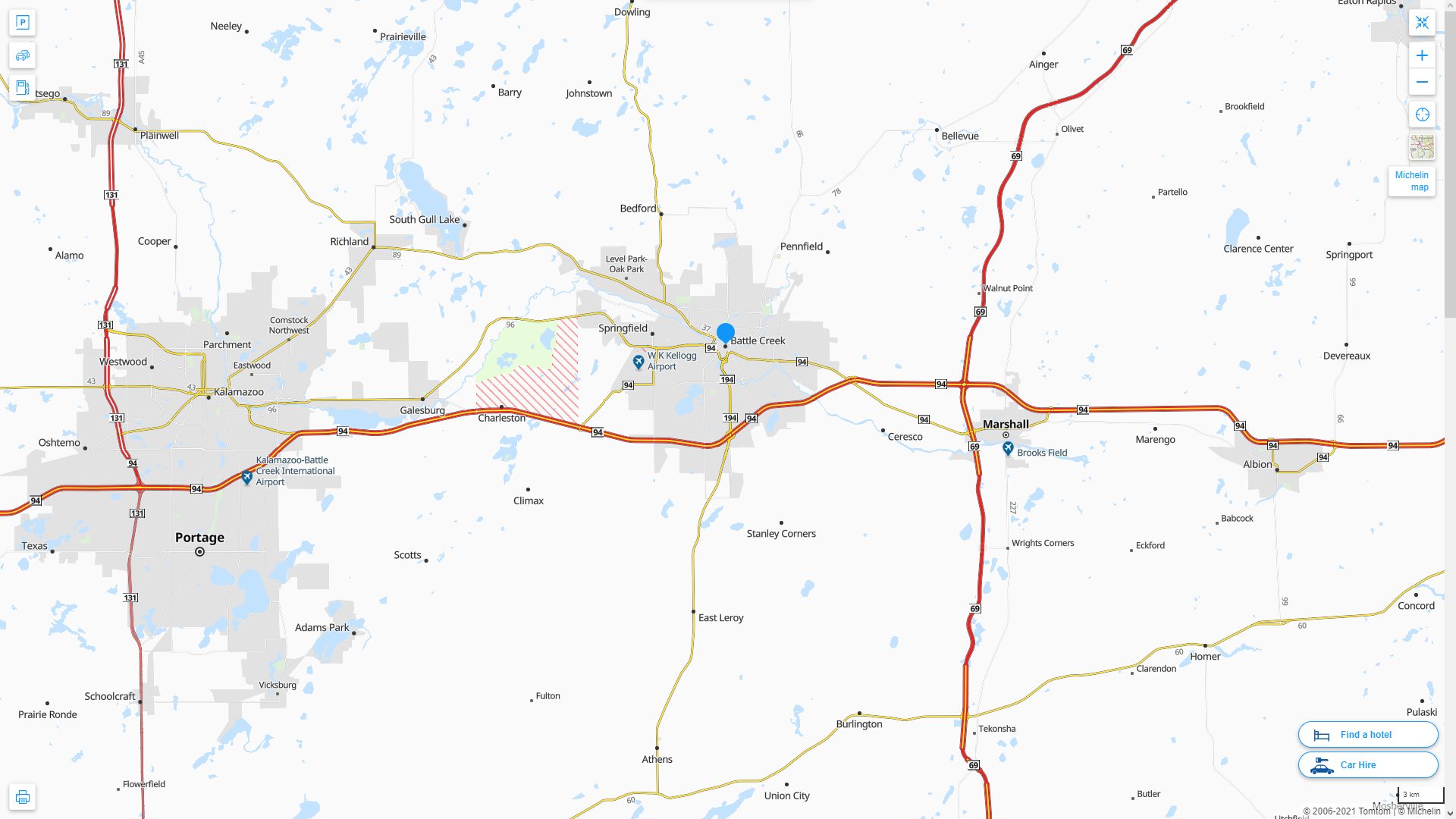

- Minimal usage of: When you are Truist provides thousands of twigs, they are located merely into the 17 says and you can Washington, D.C. Present lender players can merely apply over the telephone, but low-professionals might need to visit an actual part, and this can be inconvenient for borrowers inside the says rather than branch towns and cities.

- Good for brief financing: Truist consumers can put on for a financial loan that will discover acceptance within ten full minutes and you can investment a comparable big date. So you’re able to be eligible for the lowest APRs available, you need expert borrowing.

Truist auto loan standards

Truist will not divulge mortgage qualification criteria particularly lowest paycheck otherwise credit rating you’ll need for recognition. What’s more, it doesn’t imply criteria to possess car to be financed instance constraints toward distance or many years.

- Email address

- Proof house, for example a U.S. emailing target and you can phone number

- Domestic record

Truist advantages and disadvantages

Truist now offers competitive pricing to possess individuals having sophisticated credit, however it won’t reveal the potential loan amount up front. If you’re established consumers can put on over the phone, clients have to head to a branch really, which could not simpler according to your location.

That have a beneficial Truist car finance, you’ll need to sign up observe just what costs and you can terms and conditions Truist may offer your. Immediately after accepted, your interest rate stays repaired to possess a month. This allows plenty of time to possess evaluation hunting, if you choose to re-finance the car mortgage or pick a good the new automobile as an alternative.

Should you face pecuniary hardship on account of an organic crisis or money prevention, you can be eligible for payment relief getting ninety days. Getting qualified, you really need to have their Truist account fully for no less than nine days and also have demostrated a good fee background.

As its development within the 2019 through the merger from BB&T and SunTrust Financial, Truist is continuing to grow its visited with well over 2,000 part cities.

The financial institution even offers a variety of financial support choice, including the and utilized auto loans, car finance refinancing, motorboat finance and you will Camper money .

Although not, bringing accepted for one of those loans could be hard having some individuals, depending on the earnings, its borrowing otherwise their current address. If you would like the ease out of applying on the internet, you could potentially envision LightStream, Truist’s on the web department. Remember that LightStream’s terms and conditions, financing wide variety and you may Annual percentage rate may differ of Truist’s products.

Version of Truist automobile financing

Truist offers aggressive loan options for the purchase of brand new otherwise put cars otherwise refinancing out-of current automobile financing. Regardless if you are to buy yet another vehicle or refinancing a mature auto, the newest cost are exactly the same, between 6.24% so you can % that have loan regards to up to 84 months.

Truist now offers as much as $250,000 for automobile financing for small enterprises having regards to right up so you’re able to 75 days. Borrowers could possibly get make an application for as much as 100% funding to possess an auto, light-duty truck, van or SUV. These financing try secured, meaning the automobile commonly act as equity into the loan.

The way to get an auto loan which have Truist

When you’re already a great Truist Financial consumer, obtaining an auto loan is as easy as providing them with a visit. But if you’re new to Truist, you’ll need to visit among the twigs to apply. Realize such simple actions:

Are good Truist auto loan good for you?

If you are already a member of Truist Lender, it could be smart to discuss the auto loan solutions subsequent. Rewards tend to be aggressive costs, a straightforward app process and you will timely approval.

Yet not, their eligibility could possibly get count on your credit score and you will physical place. In the event the rating is found on the reduced side or if you dont are now living in one of several 17 claims in which Truist features a great department, it bank may not be a choice.

Regardless of whether Truist may be the best fit, it’s always payday loans Pemberwick smart to examine proposes to make sure you may be getting the lowest price. From the filling out just one form having LendingTree, you are able to located as much as five auto loan also offers away from different loan providers.

Exactly how Truist auto loans evaluate

One other loan providers play the role of on the internet financing marketplaces, taking several also offers which have one to app and allowing for effortless investigations searching without the need to get-off your property.