Estimated read time:

Figuring the expense of home financing is not an instant straightforward activity, whether you are looking for your first financial or even remortgage. You’ll find different types of costs and you will parameters to take on, out-of rates of interest so you’re able to name lengths, which can change any moment. On this page i explore the present day home loan costs and you can just what to take on when figuring the typical price of home financing.

See so it clips we brought having an entire reasons on which to look at whenever figuring costs together with latest trends and you will costs in the market:

- Average mortgage interest rates by

- Average home loan length

- What’s the average homeloan payment in the uk?

- Ideas on how to all the way down monthly mortgage payments

- Mediocre financial pricing (and appeal)

- Speak to a large financial company

Average mortgage interest rates at the time of

Some other revenue will also be provided by an equivalent bank getting more affairs age.grams. Loan so you can Really worth count, applicant’s credit score, etc.

There have been an abundance of information related the rise in Foot Rate and its own potential outcomes towards the mortgage cost. The financial institution out of England (BoE) meets just as much as every six-weeks to decide whether the Base Rate can be elevated, lower otherwise will always be undamaged.

The common financial duration

The size of the borrowed funds is an additional adding reason behind the cost of the borrowed funds. In britain, financial words are normally taken for as little as half a year and can end up being as long as 40 years. The best duration of a home loan is 25 years but 31, thirty five and you will 40 years are now provided by specific lenders.

Somebody choose take-out expanded words to lessen their month-to-month repayments. This enables them to bequeath its loan costs off to a beneficial lengthened months. But not, it does indicate that they’ll find yourself investing significantly more attract from the lifetime of the loan.

Domestic pricing has risen considerably nowadays and click resources you will mortgages more extended terms have raised inside popularity. An average Uk domestic price is actually ?286,000 for the , because compiled by new GOV.United kingdom . That it rise in home costs has made it much more hard for all of us to acquire property, such that have big places required now as well.

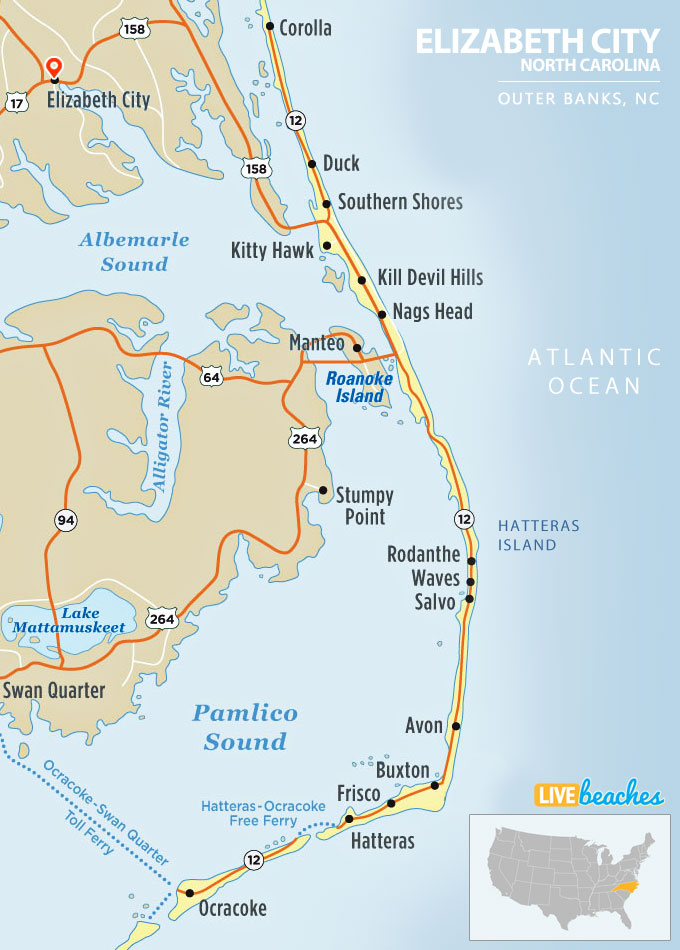

Home prices as well as are different massively with respect to the an element of the Uk, with people within the London against the most costly house prices and you may biggest mortgages.

During the , the average homeloan payment in the united kingdom was ?759, based on Llyods Financial Group. It’s grown 31% over the last ten years, however, meters onthly repayments would vary with respect to the area.

Monthly installments fundamentally are the financial desire costs, the capital cost of financial and you can any financial protection advanced. The large assortment in almost any monthly payments by the part is simply down seriously to the house costs within the all the elements. If home financing plan percentage could have been charged (typically up to ?step one,000), this might also be added towards the loan costs. Whilst you usually can choose to pay that it separately as an alternative.

It is additionally vital to keep in mind that the fresh new monthly obligations into the an excellent home loan depend on a lot of parameters, eg:

- Sort of home loan i.age. focus merely, installment or a mix of the 2

- The interest rates that the applicant is approved having

- Length of the loan title

To find the reasonable monthly payments, you should be acknowledged getting a mortgage towards the reasonable rates of interest. When you have a poor credit background, you’ll usually have to work alongside a specialist financial one tend to apply large interest levels and that highest monthly payments. The loan number and you can amount of time may also have an excellent tall influence on how much the new monthly payments are.