System brings eligible owners of owner-filled, single-loved ones property from inside the Cuyahoga County with funds to own house fix and you may drives financing to possess lower- in order to average-income (LMI) individuals, family, and you will teams.

CLEVELAND, /3BL News/ – KeyBank are integrating having Cuyahoga State so you’re able to release an alternate program that provides domestic repair help qualified residents from inside the Cuyahoga Condition. The primary Cares Mortgage SM Program, together with the house Resolve Resource Heart (HRRC), will be readily available doing . They generates through to and you can changes the problem Financing System, that has given family resolve mortgage affairs to help you qualified owners of owner-filled, single-family relations house from inside the Cleveland Levels for a couple decades.

The key Cares Mortgage SM could possibly offer an enthusiastic unsecured do-it-yourself financing all the way to $15,000 getting family fixes in order to homeowners that will manage a monthly commission but just who might not be capable be eligible for traditional bank money.

Cuyahoga State is actually happy to utilize KeyBank to include that it family repair lending program chance to citizens trying to find creating improvements on the the place to find live securely and you can securely, said Cuyahoga Condition Manager Armond Budish. This program brings the fresh new County’s overall financial support around the several household resolve attempts to have customers to help you $5.seven mil. To one another, we are helping ensure that every residents, in every community, renders developments that help their property feel a property for many years to come.

Buying and you may maintaining a property not simply provides pleasure to individuals, household, and teams, but it’s plus among the best components to create riches told you Eric Fiala, KeyBank Head out of Business Obligations & Area Connections. We have been very happy to mate that have Cuyahoga County to make the Trick Cares Mortgage SM System open to the state customers. This choice often drive financing during the areas in the Northeast Kansas, and give natives and you will teams a hack which can create wealth by the easing the burden regarding household solutions and you can repairs.

For over half a century, House Fix Financial support Heart allows home owners to maintain their house getting alternative and you can diverse communities, said Keesha Allen, Exec Manager yourself Repair Financing Center. HRRC try excited to work alongside KeyBank and you may Cuyahoga Condition due to the main Cares Financing System and you can provide a vital device to possess Northeast Kansas property owners to use for home fixes. HRRC’s customer centered approach brings technology guidelines and endeavor government so you’re able to people going for power to learn their houses fix needs and you may simple tips to browse the procedure of hiring americash loans Monroeville and you can money solutions, the origin getting finding lasting balances because of their relatives, home and you can community.

KeyBank People Which have Cuyahoga County in order to Launch Secret Cares Mortgage? Family Resolve Financing System

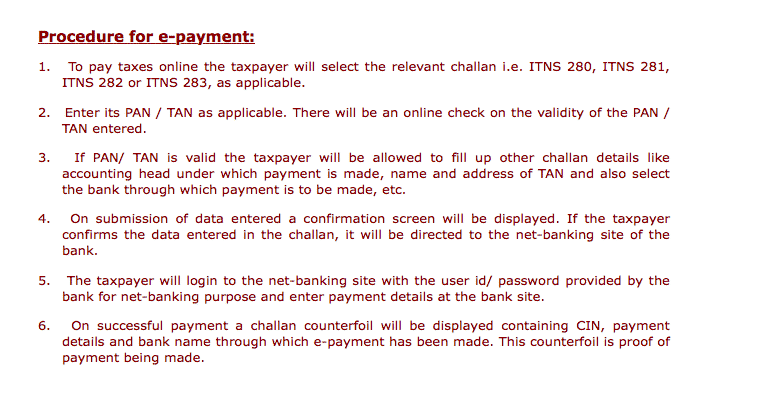

- Get in touch with your house Fix Financing Cardiovascular system to plan a consultation and you will obtain a suggestion page;

- Bring new recommendation page to any KeyBank branch in Cuyahoga State, Kansas thereby applying to own a keen unsecured do-it-yourself mortgage from Secret Cares Loan SM System;

- In the event that accepted, brand new homeowner can get went on assistance from the Household Resolve Capital Cardiovascular system on process, along with repair categories and resources, and you may economic training and you will assistance.

Since we all know you to to buy and you can keeping a house are going to be a frightening task for some, KeyBank on a regular basis partners with communities within society to increase availableness so you’re able to owning a home. These jobs let people build riches while also addressing this new money gap one to exists between Black-and-white Us americans. The new Secret Cares Loan SM falls under KeyBank’s ongoing effort to increase usage of banking services throughout Cuyahoga State organizations, especially of these in which minorities and you will lowest-to-modest earnings anybody reside.

As well, KeyBank daily conducts in depth studies to make sure we always fulfill the needs of all of our teams. Our very own studies possess located:

KeyBank Couples Which have Cuyahoga County to help you Discharge Key Cares Loan? Domestic Resolve Credit System

- KeyBank’s house lending applications and you may originations have raised inside bulk-minority census tracts (MMT) on the Cleveland MSA over the past 3 years.

- KeyBank’s loan originations do have more than simply doubled inside the most-fraction census tracts due to the fact 2020 and you can outpaced the general household financing during these components along side same period of time.

The main Cares Financing SM System belongs to KeyBank’s relationship so you’re able to enabling Northeast Ohio organizations thrive. Once the 2017, KeyBank makes more than $step one.six mil from inside the investments in your neighborhood and their National Society Advantages Package step 1 . For example more than $451 billion home based financial and you can do-it-yourself lending so you can reasonable- and you will modest-money groups.

KeyBank Couples With Cuyahoga State so you’re able to Discharge Trick Cares Loan? House Fix Financing Program

- More than $798 billion when you look at the reasonable houses and you will people creativity ideas in addition to Glenville System North, Through Sana and you will Slavic Village Gateway.

- Over $309 billion during the business fund so you can businesses that are region of reasonable- and-modest earnings communities.

- More $78.9 million within the transformational philanthropic assets in areas.

Likewise, KeyBank’s KeyBus first started their federal concert tour inside Cleveland into the . The bus went along to several communities for the Northeast Ohio, getting neighborhood professionals higher usage of financial and you can financial literacy due to offers and you will bank account setups, economic fitness analysis and you may 100 % free groups. The newest bus was a totally notice-consisted of computers lab and classroom toward wheels.

KeyBank have earned 10 Outstanding feedback regarding Work environment of your own Comptroller of your Money (OCC) into the People Reinvestment Act (CRA) examination, because of its dedication to give, put money into and you may suffice the communities, specifically reduced to modest money groups. Secret are the original U.S. federal bank one of the twenty five prominent are rated A good 10 successive times since Act’s passageway in 1977.

KeyBank’s sources shade right back almost 200 age to help you Albany, Nyc. Based during the Cleveland, Kansas, KeyCorp is one of the nation’s prominent financial-situated economic functions companies, with possessions of around $187.0 billion by . Secret brings deposit, lending, dollars government, and you may resource functions to prospects and you can companies for the fifteen says under title KeyBank National Connection through a network around step one,000 branches and you may as much as step one,three hundred ATMs. Key even offers a broad a number of advanced corporate and you will funding financial points, including merger and you may order advice, personal and private loans and collateral, syndications and you may derivatives so you can middle business businesses when you look at the chose industries throughout the the usa within the KeyBanc Investment elizabeth. To find out more, go to KeyBank try Member FDIC.