The financial comes with provides that can help you spend reduced in the long run. Can simplify their financial, and start maximising your loan now.

Simplify the banking and you may cut

It is very important make sure that your home loan and you can financial try created securely, if or not you’ve got the loan for just one time otherwise five years. It may shave decades out-of your loan and you will save some costs eventually.

We features financial round the multiple lender otherwise credit union. This is costing you even more within the effort and money than you recognise. Getting the banking in one place makes it much simpler to put enhance relaxed banking, direct debits and rehearse websites financial.

Combining costs into your home loan will save you toward attract and you can fees, once the rate of interest on home loans will likely be less than personal loans otherwise playing cards. not, it may also increase your financing label, so it’s smart to consider first should this be your best option to you personally.

Prefer financial has actually that really work for you

One of the first anything i see when deciding on an excellent mortgage is if to choose an adjustable otherwise fixed interest. How will you select? One another possess their benefits and drawbacks.

Variable rates lenders

Variable price fund often render a lot more flexible has: more payments free of charge, redraw, cost vacations and 100% offset arrangements. They might be made to enable you to repay your loan sooner in the event the we should.

Fixed price mortgage brokers

The benefit of “fixing” your house mortgage means that you understand what you might be repaying, making it easier to finances. Whereas that have a changeable-speed financing, your repayments can be “vary” given that rates alter.

Interest-merely financing

Australian Ties and you can Opportunities Percentage has many tips to possess customers seeking having fun with an attraction just fees several months as an element of the loan label. Here are some the MoneySmart , opens during the the fresh new windows guidance for some simple to follow infographics highlighting new downfalls and advantages of this type of credit build. There are also examples of simply how much expect to pay for this type of mortgage design.

When choosing that loan, a primary factor is your ability to see repayments. Play with our house mortgage fees calculator to see which financing manage perform best for you.

Developed a primary debit for your repayments

When you relocate into the brand new home it could be very easy to overlook the financial and all of brand new documentation. But it’s well worth bringing the next so you’re able to double check that mortgage repayments are set-up truthfully from the beginning.

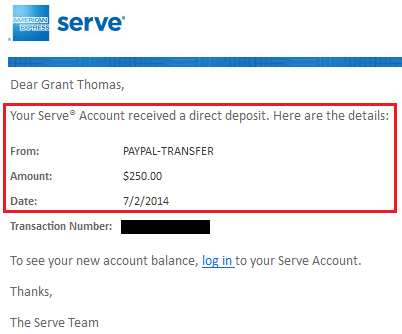

Ensure that your loan repayments are coming out from the right account. The easiest method to create a home loan payment will be to created a primary debit as a result of an everyday bank account. You’ll be able to will generate an immediate percentage from the salary straight into the loan or offset membership, however, consult your boss to be certain this might be you are able to.

Rather, log on in order to NAB Internet sites Financial to arrange an automatic payment so you’re able to help save day. Do a normal transfer by going to the amount of money Import area, The brand new Finance Transfer and nominate your import volume. This may allow you to like how frequently you want to build your repayments.

Manage fortnightly in place of month-to-month money

Believe and come up with fortnightly money on your own financial https://paydayloanalabama.com/arley/. Expenses fortnightly instead of monthly setting you’re going to be paying the similar out-of an extra month’s repayment every year, which could make a significant difference over the longevity of their mortgage. This is exactly a neat trick, especially if you receive money fortnightly.

Begin using good 100% offset membership

Having your casual bank-account associated with your house loan to own 100% offset is an easy way to slow down the attract you pay as opposed to and also make a lot more money in your financing.

Offset are a feature that one may add to their variable rate financial. They hyperlinks a typical banking or savings account into loan, and uses your bank account harmony (the cash which you have throughout the bank) so you’re able to counterbalance facing the loan balance (extent which you owe). More currency you have got on your own linked informal bank account, the fresh less attract you have to pay in your financial.

When you yourself have a counterbalance membership otherwise are considering one to, below are a few Shell out less attention on your mortgage having 100% offset for some tips.

Make use of your credit card to increase income

Precisely how performs this works? You keep your finances on the offset account, and you can as opposed to playing with that money to possess casual orders, make use of the credit card. This will help it will save you focus on your own financial. But, it’s important to manage several things if you control your finances this way.

To begin with, you must song the spending. Know the way much you will be accumulating on your mastercard. Simply purchase everything see you really can afford. Because you will see dollars on your offset membership, doesn’t mean this particular cash is readily available for spending. It’s seated indeed there to pay off the charge card equilibrium all few days.

Next, getting diligent inside paying your own credit card, in full, each month up until the due date is important. Or you would-be charged extreme appeal.

All of our playing cards enjoys as much as forty two otherwise 55 months focus 100 % free. This means for many who shell out your own full closure harmony, or you features an equilibrium import brand new ‘interest free days payment’, of the due date monthly, you might end credit card notice plus the money in your offset account form you have to pay shorter interest in your financial.

Setup their redraw studio

A good redraw business enables you to access any extra payments your have made to your residence loan if you want all of them. It offers a few secret benefits: this means it is possible to make more money, thereby rescuing into the attract can cost you; also it brings flexible entry to loans while they are most required.

That it redraw element can be acquired with all of our variable rate family loans (leaving out strengthening funds and you can Defence Residents Mortgage). Supply these types of finance effortlessly owing to sites banking , opens up in brand new window . Redraw try not available for those who have a fixed rates, framework otherwise Protection Property owners loan. To possess fixed-speed home loans, redraw is only available at the termination of the fresh new fixed rate several months (ie. in the event that speed gets adjustable).