Certain financial advisers endorse getting a 25% signal, someone else to own an excellent twenty eight% signal, however, in any event, the concept should be to separate your get-household pay otherwise websites pay of the .twenty five (or .28, when you find yourself going by twenty-eight%), to find the number that best suits your finances.

See The choices

Once the a physician, you really have alot more alternatives for a mortgage than people. You will likely have the ability to secure a mortgage loan rather than a downpayment, and you may without having to pay PMI.

These are great features! After you influence a payment per month where you’re comfortable, think also the duration of the borrowed funds.

30-Year

A 30-12 months loan is named a normal mortgage for a description. Just because the borrowed funds was spread out more than a 30-year several months does not always mean you have got to stay-in the newest home to own 30 years. That time of your energy is basically the way the principle and you can attract was calculated to be able to has actually a fair payment per month to your house for which you alive. You can offer the house when, plus doing this, pay the loan.

A 30-season mortgage typically has a fixed rate of interest, so your payment does not change year more 12 months. In the event the rates rise across the country, you are secure while closed inside the a lesser rates. If the rates of interest decline, you will not manage to benefit from all of them unless your refinance the loan. This means you take aside another home loan to change the latest old you to, along with the closing costs that come with processing a mortgage mortgage.

15-Season

You may pull out a fixed-rate mortgage for fifteen years in lieu of 29. That may generally end in less interest rate but high monthly installments. This is basically perhaps not your best option when you find yourself a good citizen and you will learn you will only be in the house for 5-eight ages.

Changeable Rate Mortgage (ARM)

A varying-speed mortgage, labeled as an arm, would be a great choice if you know you simply will not feel in the home long-identity. Just like the name do indicate, on a yearly basis, the rate to the a supply can be adjust, highest or all the way down. Because of this your payment may go up or off on the an annual base.

For somebody when you online payday loans South Carolina look at the a property enough time-title, brand new varying might possibly be tiring. But when you will only get in the house for 5-eight ages on account of residence, you might benefit from the down interest that you wake up top and can trip out people movement from the field which can already been afterwards because you will provides marketed the new house.

Make your People

After you have computed how much cash home you could conveniently afford, make sure to have the correct professionals around you.

A buyer’s broker allows you to find the correct domestic for the your own spending budget. That individual also may help you discuss to get the best speed towards the industry, and never overpay.

Debt advisor helps you understand the huge image. This person will help you to devise an idea so you’re able to pay your own fund nonetheless benefit from the advantages of homeownership.

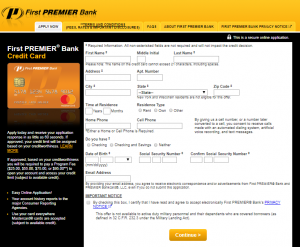

The latest lender’s job is to present different alternatives having money you to definitely are around for you as the a health care provider. They are able to give calculations about how other rates and you will variety of loan activities tend to affect your own conclusion: new monthly payment.

Just how D House!

You’re an early doc which have minimal discounts and no works records. You have got higher quantities of personal debt from the scientific university funds, you want it a home to avoid purchasing lease and start strengthening security.