Stretched Desire: If the refinancing identity concerns stretching the loan name to cut back monthly premiums, its essential to understand that this variations may lead to high focus costs along side entire mortgage stage. Before you decide to refinance your financial, its good for thoughtfully consider the fresh new exchange-away from ranging from immediate brief-name economic save as well as the prospective much time-title effects out of an extended financing period.

Qualification Pressures: If you find alterations in your financial situation, such work losses or improved financial obligation, you could find yourself ineligible to the intended refinance you are seeking.

On Canadian a property land, the decision to re-finance your home loan are an incredibly favorable you to definitely, requiring careful consideration of the monetary needs and items.

As the you’ll receive ready to refinance, get in touch with we to assess their much time-label monetary specifications to ensure that you have the new price and terminology you are searching for. To each other, we will help you make an educated decision you to definitely aligns having your specific finances on latest market’s land in your mind.

Dominant, Wealth Director, and you can Writer | Money Manager delivering resource and you can wide range mgmt so you’re able to winning entrepreneurs, professionals, retired people & their loved ones providing all of them make advised monetary decisions | Why don’t we cam!

The newest statement of the Government Mortgage Financial Agency (Freddie Mac computer) with the , one 29-season fixed-price mortgages provides fallen on the reasonable level of the entire year, averaging cuatro.08 %, has some home owners thinking if the this is the time to help you refinance. Whatsoever, for the general rate of interest mind-set demanding an ascending trend–influenced by the likelihood of 2 or three Federal Set aside price hikes–would it make sense to secure a lower rate now, before cost of credit increases?

Initial factor are, naturally, the latest currently available interest rate in comparison with the rate into the your loan. Most of us have read the historical principle one if you fail to rescue at the least a couple full commission items lower than your overall rates, refinancing isn’t really worthwhile. Even though many question brand new validity of a couple of % laws, it is true one to saving cash on the interest ‘s the amount-that reasoning the majority of people refinance.

A unique foundation was go out. If you plan to stay in your residence for a long go out, also an inferior speed prevention accumulates in order to thousands of bucks within the appeal spared inside lifetime of the loan.

Gordon Bernhardt

Obviously, there are more will set you back to adopt together with the rate of interest. Closing costs will add several thousand dollars into the bills out-of a great refinancing. It’s adviseable to look at the complete amount might pay across the more than likely length of time you happen to be regarding the financing. Although the payment you are going to miss because of a beneficial refinancing, greatly stretching the word of your loan you will definitely nevertheless lead to thousands of most dollars paid in appeal.

Very, particularly, in the event the overall settlement costs towards the refinance is $step 3,000 additionally the the latest fee could save you $100 monthly, new breakeven part are 30 days. Do you propose to be in your house rather more than 31 days? In this case, refinancing could make feel.

Property owners can also enjoy several free online financial calculators Nevada installment loans so you’re able to assistance with the amount-crunching. Quickenloans, LendingTree, and you may BankRate are merely about three of your those economic websites that provide totally free equipment you need accomplish your hunt.

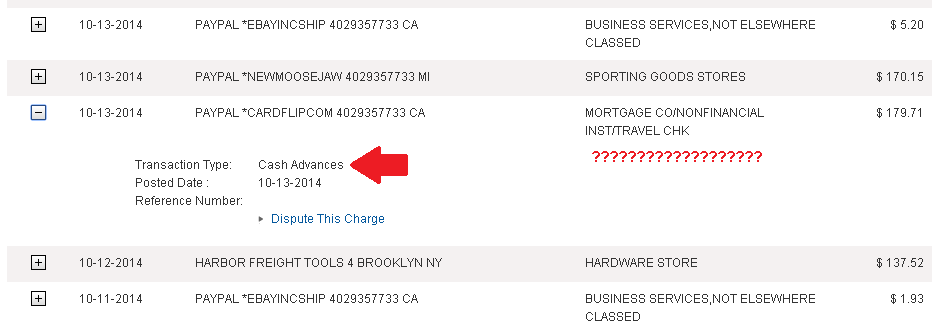

In the end, a word-of alerting: Look out for their intentions to own refinancing. Often, converting your own collateral so you’re able to bucks can allow you to purchase a business, buy a property redesign one adds really worth, otherwise pay money for education. But refinancing to settle credit card debt enjoys a drawback. Even though it is higher to get rid of one large-desire personal debt, the brand new downside would be the fact the thing that was personal debt is becoming protected–by your home. Forgotten mastercard money tarnishes your credit rating and certainly will results during the awful collector calls. But destroyed their mortgage payment normally forfeit your property to help you property foreclosure.