Local rental characteristics can have as much as five devices or is also end up being a great duplex otherwise triplex. The house can also be a house in which a space are hired otherwise a property having a special flat towards the property.

Consumers might even get one possessions, real time there having annually and then do this again that have several buildings until they come to a finance limit known as the entitlement maximum.

Another advantage out-of Virtual assistant mortgage loans: borrowers can use the latest rents from other devices throughout the building so you can qualify for the mortgage from the plus that lease since income. Usually, they are able to include 75% of the market rents for the their being qualified earnings.

With the downside, the latest rental assets need to be into the move-into the reputation and discovered approval from a great Va household appraiser prior to the loan might be recognized.

Family guarantee personal lines of credit (HELOCs)

HELOCs are similar to handmade cards. You could withdraw any matter, any time, up to your own restrict. You happen to be allowed to spend the money for mortgage down or out-of at tend to.

HELOCs has several phases. Inside draw months, you use this new credit line all you have, along with your lowest commission will get security precisely the interest owed. But sooner or later (constantly once 10 years), the fresh new HELOC mark period stops, as well as your loan goes into brand new payment stage. Thus far, you could don’t mark funds together with financing gets fully amortized for the left ages.

Compared to traditional mortgages, HELOCs bring alot more flexibility minimizing monthly payments inside mark several months. You can borrow as often otherwise as little as need – when it’s needed.

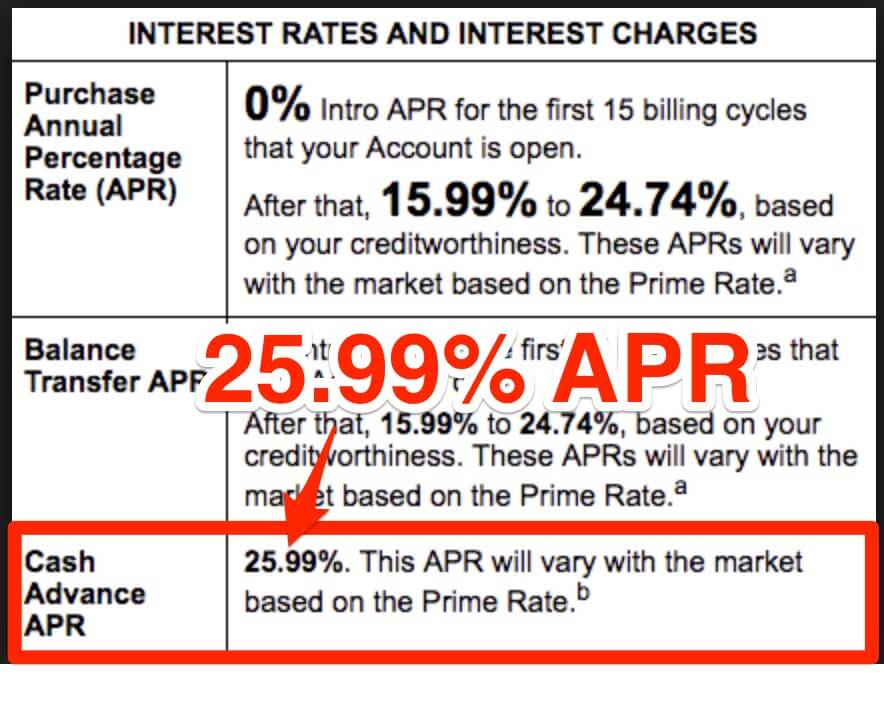

The possibility cons could be the variable rates (and that rise in combination to your Government Reserve’s prime rate) therefore the possibility the monthly premiums you may skyrocket due to the fact installment phase begins.

However, as opposed to a hard money financing, an excellent HELOC possess a great deal more risk connected: or even already very own a residential property, you are able to secure the HELOC along with your number one residence. For folks who default on the financing, the lender commonly foreclose on the household, perhaps not brand new money spent.

For people who already very own a residential property, you might defeat this dilemma by applying for a good HELOC towards the one or more of these characteristics. Really the only key try trying to find a lender.

Due to the fact of a lot home investors defaulted inside 2008 property breasts, plenty of finance companies wouldn’t accept family security credit lines which can be secured by the financing qualities. The few financial institutions that do bring this type of HELOCs make it much harder in order to be eligible for her or him than simply they once did.

Loan providers will want to come across all the way down personal debt-to-income rates (30% so you can thirty-five% to possess investment property borrowers rather than forty% for somebody borrowing against a primary residence). And they’re going to including fees large interest levels otherwise require your to invest 2-step 3 points initial.

Although not, you can need a HELOC on much of your quarters during the much better words. Upcoming, use the proceeds and make a downpayment towards a good investment property.

Other available choices if you have equity made in a primary residence or any other investment attributes include a property guarantee mortgage otherwise dollars-aside refinance.

Supplier capital

Inside rare cases, you may be capable receive supplier capital getting a financial investment property. Labeled as owner funding, a land price, or a contract having deed, this is exactly an arrangement where in actuality the vendor will act as the financial, providing payday loans without bank account in Ridgebury you with an exclusive mortgage.

In place of getting a timeless loan by way of a mortgage organization otherwise bank, your fund the purchase into established manager of the home.