The brand new deciding cause of if or not a house was a mobile home is the go out it was made. Factory-established home made before Summer fifteen, 1976, is cellular belongings. At that point, HUD introduced the fresh Federal Are built Houses Construction and Safeguards Requirements Act. After that date, brand new cover criteria was basically accompanied and these belongings got the newest designations.

A cellular house is founded on a manufacturer and brought to web site to arrange. It could have used metal wrap-lows in the place of a charity. Land produced pursuing the being qualified go out features improved criteria, but their really worth drops for the venue, location, location concept from real estate: The area goes a long way in order to choosing the benefits.

Modular Home

Standard home are created when you look at the a manufacturing plant however, come up with in the site where in actuality the family was found. These residential property will be produced in two or even more modules (ergo the name), and you can developed on site of the local designers. Modules you’ll put bed room, or done areas having wall space and you may roofs. Plumbing and electrical expertise was installed up until the modules are shipped.

Modular interior decoration has come a long ways. Most are two tales, some has cellar. Most of the features popular features of conventional property, as well as optimal energy savings. Buyers could even build the house on their liking. Brand new homes should be wear flat house, otherwise land which was prepared to accept brand new modules.

Ways to Finance a produced Domestic

- In which do you ever put the domestic? The mortgage might be towards house only, thus you will need to both choose the house because of it due to some other mortgage otherwise lease certain homes through a cellular domestic community. Leasing property you will indicate you would not be eligible for specific loans.

- Bigger house is almost certainly not eligible for certain fund To shop for a dual-broad home one to can cost you $one hundred,one hundred thousand or higher actually anticipate in a keen FHA financing. Restriction financing number differ of the particular home purchased.

- Contrast loan providers Not merely in the event that you examine the sort of loan, but observe how charge and you may interest levels will vary certainly one of lenders.

Bank or Credit Commitment

For people who very own the newest property beneath your are built domestic, you are in luck. Banking institutions, borrowing from the bank unions or other lenders constantly require that you very own the fresh new end up in buy to locate a mortgage.

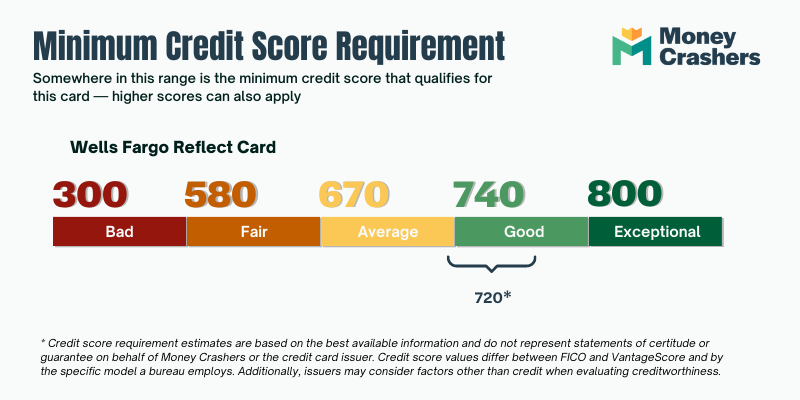

For folks who very own the fresh property, financing a produced house is fairly exactly like financial support a timeless family. You will want a credit rating on the mid-600s, a down-payment off ten%-to-20% (as low as 3.5% having a keen FHA financing), and you may income which is around you to definitely-third the loan.

On the internet borrowing guidance out-of InCharge Debt Selection may help. InCharge are a beneficial nonprofit borrowing guidance institution that provide a free picture of your own credit report. It assists your come up with a cost plan for credit card debt, instance an obligations administration program.

In addition to improving your credit rating, having brand new homes we need to lay a manufactured family into makes being qualified for a financial loan easier.

When you find yourself 80% payday loans Thomaston regarding were created belongings are owned by the populace, simply fourteen% of these anyone including own the new lot on what the device is put, considering Property Guidance Manage, a beneficial nonprofit organization that tracks sensible houses.

Otherwise anticipate to invest in home for the are manufactured domestic, you could potentially however finance the acquisition with a bank otherwise credit connection bank, or even by way of help from the federal government. Such apps are made to assist consumers rating mortgage loans to your are created homes, and therefore account fully for eight% of You.S. housing industry. That is almost 22 million home.