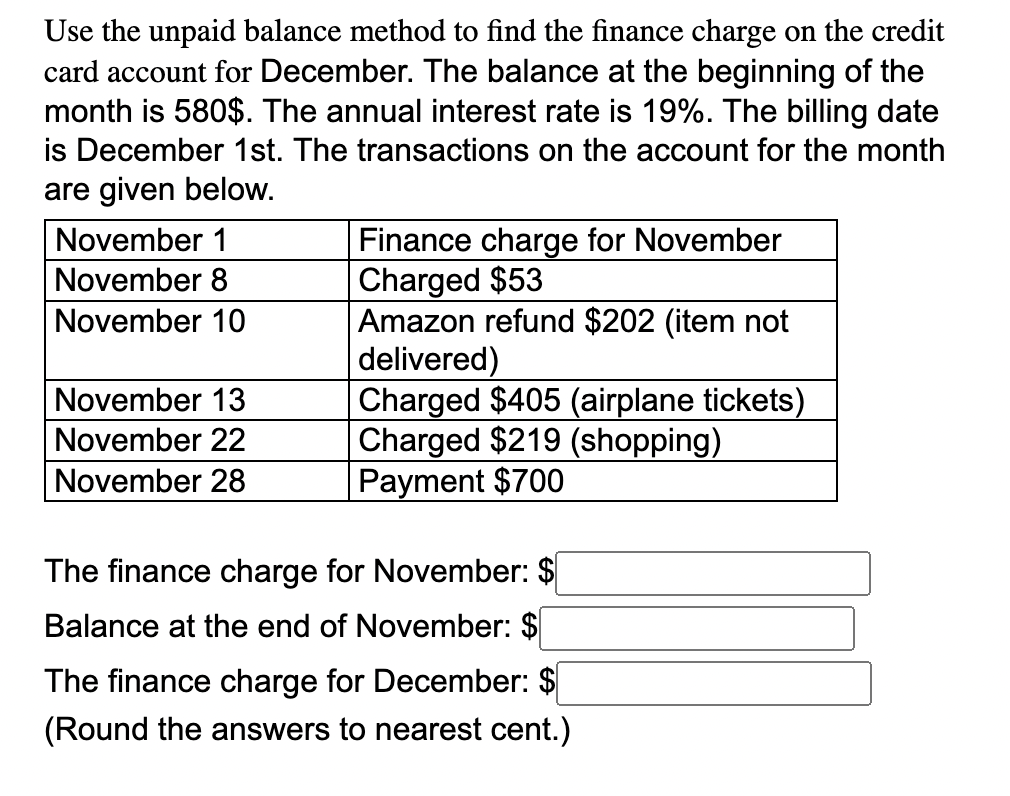

Tips

- Before you hurry to improve banking institutions, pick up the phone and phone call your existing lender observe just what it could possibly offer.

- Refinancing is save normally $2000 a-year, so play with you to since your standard when considering a separate give out of your lender.

- Of numerous banking companies bring benefits such short-term speed deals, repeated flyer points and you can wads of cash, but research your facts appealing even offers normally sting ultimately.

- Prevent stretching your residence loan straight back over to thirty years whenever your refinance, since this is wind up charging your thousands of most bucks.

- Positively take control of your financial of the examining into the on it most of the about three weeks.

Real cash, a totally free each week publication providing specialist easy methods to save, dedicate and then make many of currency, is sent all the Week-end. You might be learning an excerpt ? sign up for get the whole publication in your email.

24 months in the past, otherwise just as much as about three aeons in the COVID go out, Australian home owners have been treated to 1 of the greatest refinancing environment from inside the previous memories.

Rates of interest had been during the price-cellar levels of dos-3 %, for even fixed-speed money, and you can banking institutions was basically supplying comically higher stacks of money into the a you will need to woo new customers. It had been the very best of times, but, because the Nelly Furtado shortly after told you, every good things go out.

Refinancing your house financing will save you some cash, but there are several important matters to keep in mind after you start the method. Credit: Aresna Villanueva

Today, refinancing is significantly faster fun. Average interest levels was sitting at about six.step 3 per cent, even for repaired pricing, and banking institutions are not as the liberal with the heaps of money. Making matters bad, we whom grabbed benefit of the new halcyon times of reduced prices and you may repaired our loans are in reality watching those people financing prevent, and are usually facing the brand new well known mortgage cliff.

What is the problem?

The fresh rising prices entails Australians is scrounging getting offers wherever they’re able to locate them, with all of our mortgages being one of the primary expenditures impacting the base lines, there’s absolutely no ask yourself all of us are race so you can re-finance. Depending on the Australian Bureau out-of Analytics, $20.dos billion property value mortgage brokers was indeed refinanced in the Summer, a little drop on the week early in the day but nevertheless during the listing levels.

Your skill about this

If you are individuals peering along side home loan cliff, or just looking to save some money per month, here are some tips on precisely how to top do the method.

- Log on to the latest blower: In advance hitting up Yahoo and you may sussing out costs at other banks, it’s well worth picking right on up the phone and contacting your lender, says Samuel Philipos, dealing with director in the Open Lenders. Exactly what the audience is seeing on huge banks right now are you to definitely they have a lot more self-reliance that have providing alot more competitive also offers to remain with them, according to him. An average of, Philipos states refinancing is save you $2000 a year, so play with you to as your benchmark when considering an alternative bring from your https://cashadvancecompass.com/installment-loans-ca/long-beach/ own lender.

- Be mindful new benefits: We all love delivering huge piles of cash, however, appealing also provides out of lenders can be too-good in order to getting correct alerts Sally Tindall, look movie director on RateCity. Upfront rewards supplied by finance companies to lure you to switch normally feel like a white knight, but they could potentially pain your from the long work on in case the constant interest is not aggressive, she says. This type of benefits can come when it comes to short-term rates deals, regular flyer factors and people large hemorrhoids of money. Perform the maths, and you will you should consider about precisely how continuously you are likely to re-finance, to determine what one is browsing place you to come.

- Never offer the loan title: While it will be tempting to give your loan back aside in order to 3 decades after you re-finance to lessen your payments, avoid that it where possible, Tindall states. If you are 5 years on the a 30-year mortgage term, following pose a question to your new financial for a 25-year mortgage label (or faster), she says. Maintaining your mortgage to own a supplementary 5 years contains the possible so you can cost you thousands of dollars a lot more in the end.

- Actively control your financial: You have observed definitely handled expenditures, but most people are more couch potato in the event it pertains to our home funds. This may leave you paying over you need to, Philipos says, in which he recommends examining when you look at the in your mortgage every 3 months. It’s not regarding how usually you option, but how much you could be lost, according to him. Every three months, easily comparison shop, discuss together with your financial, and view precisely what the variation are. If this attacks the newest tipping section, after that switch.

- Keep an eye on the expense: They will cost you normally $1000 so you’re able to re-finance, thus component that for the if you find yourself settling. Particular finance companies have a tendency to waive particular refinancing charges if you ask, so be sure to do.

Recommendations given in this post try general in nature which will be not intended to dictate readers’ behavior on expenses otherwise lending products. They should constantly look for their qualified advice which will take into account their unique individual facts prior to people monetary behavior.