- Take note of the qualifications criteria and you will value prior to getting an excellent second assets.

- The previous upsurge in Additional Consumer’s Stamp Responsibility (ABSD) setting you would you desire much more cash when purchasing a moment domestic.

- To order a moment possessions comes with way more economic duty; it is told become clear regarding your objective for buying the second property

Which have rising prices dominating statements into the current months, rates of interest are set to rise after that throughout the future months. When you yourself have come browsing acquire the second property, this can be an enjoyable experience to start appearing once the a great increase in interest rate might just mean stabilisation out-of property prices.

Besides the price of the home, there are several things you would need to be aware of when to get an extra domestic, particularly eligibility, cost and you may purpose.

Qualifications

For individuals who own a personal assets, you will then be able to purchase a second individual property without having any courtroom ramifications. But not, if your earliest home is a general public houses, whether it is a set-up-to-Order (BTO) flat, resale HDB apartment, executive condo (EC), otherwise Construction, Create market Program (DBSS) flats, then you’ll must fulfil certain conditions in advance of you buy.

HDB flats feature good 5-season Minimal Job Period (MOP) specifications, for example might need invade you to property getting good at least five years one which just offer or book the flat. Additionally need to complete the newest MOP before the get out-of a personal assets.

Would keep in mind that just Singapore residents should be able to own both a keen HDB and you can an exclusive property at the same time. Singapore Permanent People (PRs) will need to escape of the flat within half a year of your personal assets buy.

Affordability

Residential properties are known to be infamously pricey within the Singapore and careful data need to be built to make sure your 2nd assets get remains sensible for you. You’ll have to take mention of the pursuing the:

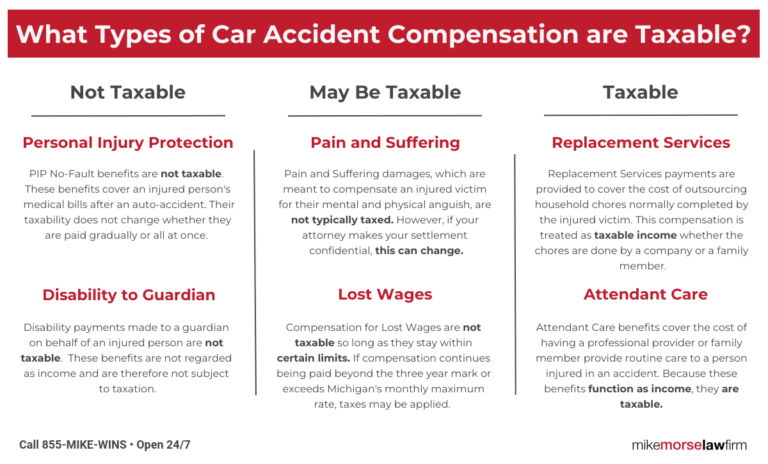

You might need to pay ABSD once you buy an extra domestic possessions. Extent you’ll have to pay hinges on their character.

The ABSD try past modified with the included in strategies to offer a lasting property market. Current rates are shown throughout the dining table less than:

Because of the newest ABSD costs, an effective Singapore Citizen exactly who already owns an enthusiastic HDB flat however, wishes to acquire a private condo charging $one million needs to pay an enthusiastic ABSD of $2 hundred,000 (20%). Create observe that it count is found on the top of client’s stamp duty.

Your first house buy needs merely to 5% dollars downpayment if you used a bank loan, but your second assets needs a twenty-five% cash deposit of your own property’s valuation maximum. Offered a property that’s appreciated in the $1 million, you’d you want $250,000 dollars getting deposit.

The Obligations Maintenance Ratio (TDSR) construction try introduced to end home buyers from borrowing from the bank as well far to finance the acquisition away from a home. Beneath the structure, home buyers can just only use in order to right up 55% (modified toward ) of its gross monthly earnings.

For those who have a home loan associated with your first assets buy, it does considerably affect the matter you could potentially use for the 2nd house. Although not, when you yourself have currently cleaned the mortgage on the first house, then you’ll definitely only need to make sure that your monthly property financing costs and virtually any month-to-month bills dont surpass 55% of your monthly income.

To suit your very first property loan, you are permitted acquire to 75% of the house worth when you’re using up a bank loan or 55% in the event your mortgage tenure is over 3 decades or runs past ages 65. For your 2nd homes financing, your loan-to-well worth (LTV) ratio drops so you can 45% having loan tenures to thirty years. If for example the loan period surpasses twenty five years otherwise your own 65th birthday, their LTV falls to help you 29%.

Clearly, to invest in the next assets when you are however paying for the borrowed funds out of the first household would want far more bucks. Based on a property valuation from $1 million, you will probably you would like:

While it’s you can easily to make use of the Central Provident Money (CPF) purchasing the next property, when you yourself have currently made use of your own CPF for your requirements first home, you could potentially just use the excess CPF Ordinary Account deals having your second assets shortly after putting aside the current Basic Retirement Strategy (BRS) off $96,000.

Purpose

To find the second possessions boasts much more financial obligation versus very first you to, and is told become obvious regarding the purpose to possess buying the second property. Can it be for resource, or will you https://paydayloanalabama.com/fayetteville/ be utilizing it because a second household?

Making clear their goal allows you to for making certain choices, like the sort of property, and additionally going for a location who does most readily useful match its goal. This might be especially important in case the 2nd home is a financial investment assets.

Like any most other expenditures, you might need certainly to workout the possibility leasing give and you may financing prefer, and determine the estimated profits on return. Because the a house purchase is a large money, its also wise to keeps a method you to definitely thought facts eg:

What is forget the panorama? Might you seek to bring in a revenue once 5 years, or even retain it into much time-identity to get book?

Whenever and how do you slashed losses, if any? Whether your mortgage repayments are higher than the lower rental income, just how long do you realy hang on just before selling it off?

To invest in a home inside Singapore are financial support-extreme and purchasing a moment home will need alot more economic prudence. One miscalculation have significant monetary effects. Therefore, install a clear bundle and request a wealth planning manager to help you with you are able to blind areas.

Initiate Believe Now

Here are some DBS MyHome to sort out the fresh new sums and acquire property that meets your allowance and you will choices. The good thing it cuts out the guesswork.

Alternatively, prepare yourself that have an in-Idea Recognition (IPA), which means you features certainty about how precisely much you can obtain to possess your home, letting you understand your financial budget precisely.