Within this publication

When you find yourself more than 55, equity launch enables you to unlock some of the worth from inside the your home without having to offer up-and flow.

You’re taking out financing shielded up against your residence of an equity discharge vendor, that is following paid when you’re for the a lot of time-identity proper care otherwise pass away.

Research regarding Collateral Release Council suggests that users accessed ?2.6 million into the property wealth via guarantee release items in 2023, since level of clients using guarantee discharge rose so you can 5,240 anywhere between 12% higher than the prior one-fourth.

Although not, taking out fully a collateral launch bundle is a huge choice and you will there are numerous downsides to take on, you need certainly to think before going in the future.

What’s collateral release?

If you are a resident old 55 or old, you will probably find that you will be family-steeped but cash-terrible. Thus you really have more value tied up in your house than simply you are doing when you look at the obtainable cash and other assets.

Guarantee discharge are a means to possess older people to turn some of your own value of their property with the dollars without having to circulate. It’s generally a specific version of mortgage that is shielded facing their possessions.

It is similar to home financing but that you do not make ongoing, monthly payments. As an alternative, people interest you owe is actually placed into your loan and stimulates up over time. The borrowed funds is actually sooner paid down after you perish otherwise transfer to long-title care.

Considering the method collateral launch work, the eye money can result in the cost of the borrowed funds in order to balloon. Security discharge can be high priced than the remortgaging otherwise downsizing, https://paydayloanalabama.com/roanoke/ with costs typically greater than simply basic mortgage loans.

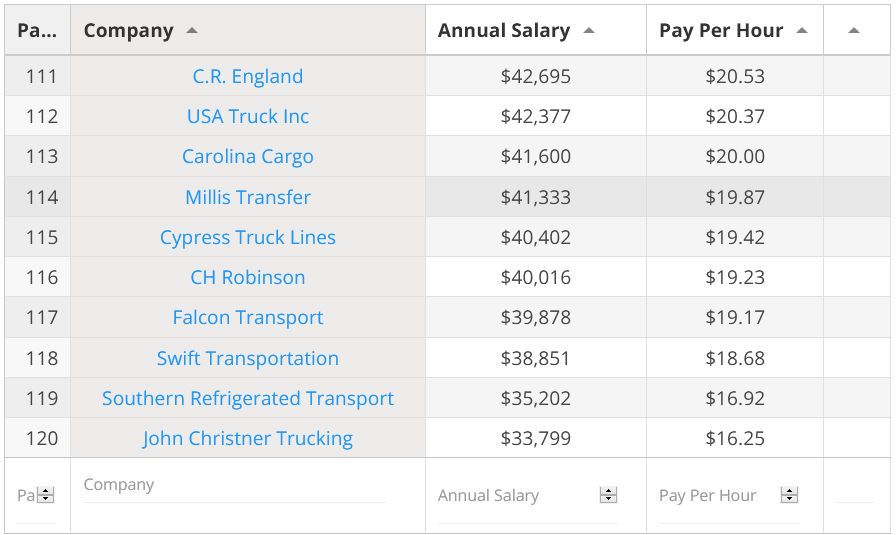

How much cash can you borrow?

The absolute most you can obtain may be around 60% of the property value your house, according to government’s Money Guidance Service.

How much should be able to acquire utilizes things just like your years in addition to value of your residence. The brand new commission usually increases considering your actual age when taking aside the merchandise.

- How old you are

- How much cash you reside really worth

- The state of health

- You to bucks lump sum payment

- Faster, regular payments

- A combination of one another

Guarantee release calculator

Make use of the free equity release calculator for instance the you to less than so you can get an idea of how much cash you could borrow.

Exactly how has rate of interest changes affected guarantee release money?

Decades of very cheap pricing fuelled an equity release boom, with individuals unlocking accurate documentation-cracking ?six.dos million of money from their land in 2022.

Yet not, the amount of dollars create courtesy security release sank to ?2.six million within the 2023, following several sharp goes up when you look at the interest levels. Which made the cost of borrowing from the bank higher priced and made the new amount owed towards security launch agreements balloon quicker.

For the Bank out-of England base rate shedding off 5.25% so you can 5% into the August, specific expect security discharge rates will start to slip slowly.

Rachel Springall, a money professional at the , said: Fiscal conditions, interest levels and you may field balances all the gamble their area whether or not it concerns the new costs out of lives mortgage loans, as lenders must make sure they set their cost lined up employing emotions so you’re able to chance.

The bank out-of England feet speed slashed really does determine business belief resulted in the new re-prices from lives mortgages. Although not, loan providers was alert to people predictions surrounding the future standard of interest pricing which could make them hesitate to drop prices by the prominent margins.

Additionally there is ongoing suspicion as much as whether or not property cost will get slide later. Yet not, under statutes enforced during the 1991, factors include a no bad guarantee make sure, for example the newest borrower cannot owe more the significance of its property.